Home » 2013

Yearly Archives: 2013

Real inflation? – Time to revive old concepts! 着実なインフレと思わない

Issue

The “flash” release of consumer prices in central Tokyo for November show Japan’s CPI is back in positive territory for the first time in 15 years, with accompanying headlines. Never mind that the current level is barely positive (and that for most of the period the level was barely negative); we’re told that Abenomics is working.

That judgement is premature. To date the rise in consumer prices is limited to energy (including the hike in electricity prices thanks to the nuclear shut-down) and imported goods (the weaker yen). While the overall index shows a 0.9% year-over-year rise, that falls to 0.2% once food and energy are excluded. Then there are import prices; TVs contributed 0.1 percentage points to the total, while overseas “package” vacations were up 12.6% in price. However, domestic services are the biggest part of consumption, and health care costs dropped 0.9% relative to November 2012. So in my reading the data provide no indication that the rise in consumer prices will continue after these one-time effects – the nuclear shutdown, the yen depreciation – work through the economy. [See here for the data.] (more…)

Japan’s Auto Industry and High-Tech Dreams

In the online NBR Japan Forum (and in a chat with a retired vice miniser of METI – the Japanese Ministry of Economy, Trade and Industry [経済産業省]) – I hear about how electronics, hybrids, and yes, fuel cell vehicles will turn around the [domestic] Japanese auto industry, including suppliers who can use their cumulative engineering and manufacturing skills to profit from this.

As evidence, they point to the Prius as a huge success, including as the top-selling vehicle in Japan.

This faith in new technologies as the industry’s salvation is wrong on three counts.

Auto parts suppliers price fixing and Japan

The conspiracy of Japanese wiring and electronics suppliers to put the screws to Toyota and other customers has now led to the largest antitrust action in history. What we know appears stupendous in scope. To date 20 suppliers have paid fines totaling $1.6 billion in the US (an additional $347 million in fines in Europe and Japan brings the total to $1.95 billion). Some 21 executives have pleaded guilty to felony antitrust charges including jail time and financial penalties. Wired participants, secret locations, coded communication and an expanding list of auto parts and firms, spanning 10 or more years and at least 4 continents. Wild!

…once customers have been screwed for a while, it starts to feel normal

Then there’s what we don’t know. To date all of those charged have pleaded guilty. As a result, the Department of Justice (and their counterparts in Japan, the EU, Canada, Mexico, Korea…

View original post 1,050 more words

Where oh where can I put my savings?

Post by Mike Smitka

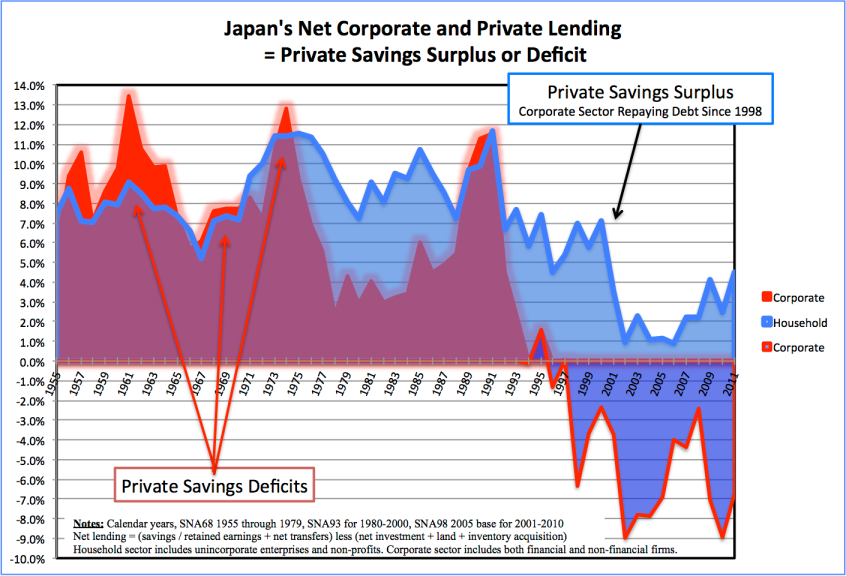

I’ve played with the latest yearbook of system of national accounts data for Japan, adding the 2011 data to an existing spreadsheet. Unfortunately the detailed System of National Accounts data aren’t published until roughly a year after then end of the fiscal year, so CY2011 are the latest.

…companies would rather sit on cash than invest…

For various reasons (particularly when data are chain-linked), past data are adjusted retroactively. [Pardon the oxymoron: all data are for the past!] All I did was plug in the latest, not go back to adjust for shifts in 2008-10. In any case, we don’t have a continuous time series, so it’s arbitrary how to link old series and new series – though we should be thankful that the statistical authorities continue to improve their data collection and accordingly the details of GDP calculations.

So the graph here is for now the best we can do, until the next data are released, probably in summer 2014. (more…)

Japan’s New Young Women

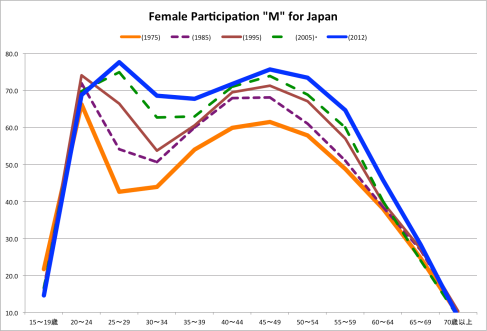

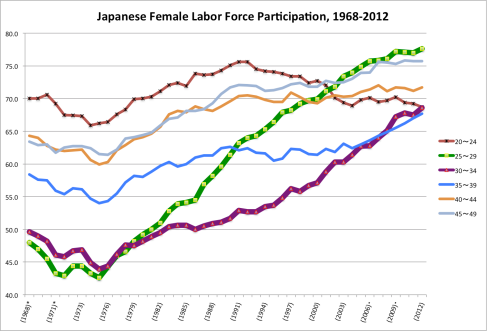

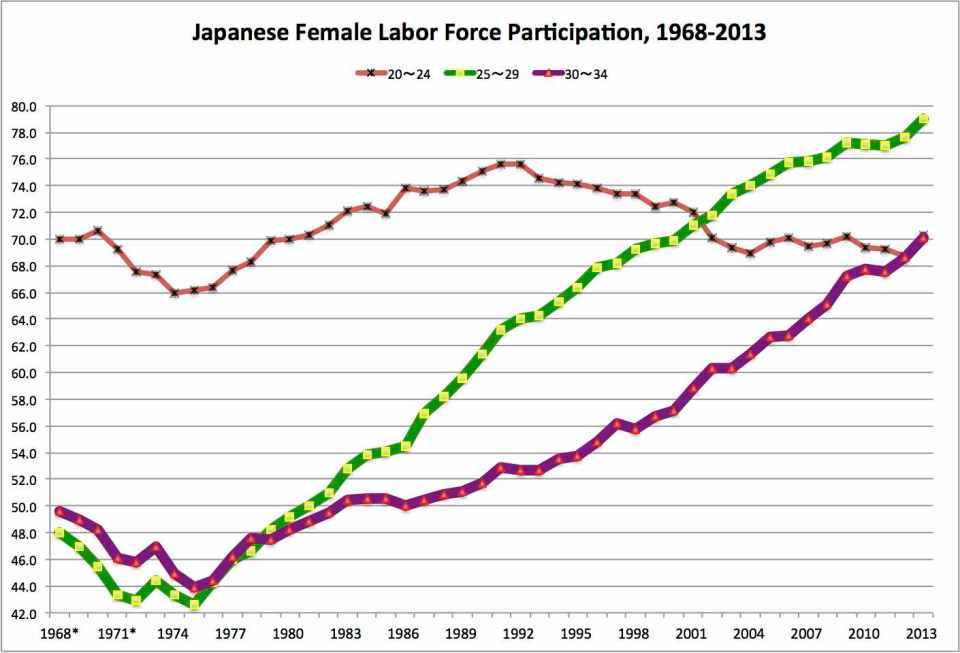

A concurrent set of posts on the NBR Japan Forum is on the role of women in the labor force. At younger ages, the shift towards greater participation is dramatic, a 30 percentage point jump among 25-29 year olds. Participation for women age 30-34 is following in parallel, with about a 13 year lag:

However, this is less economically meaningful than at first glance. Women are not going to be able to save Japan from its demographic challenges. (more…)

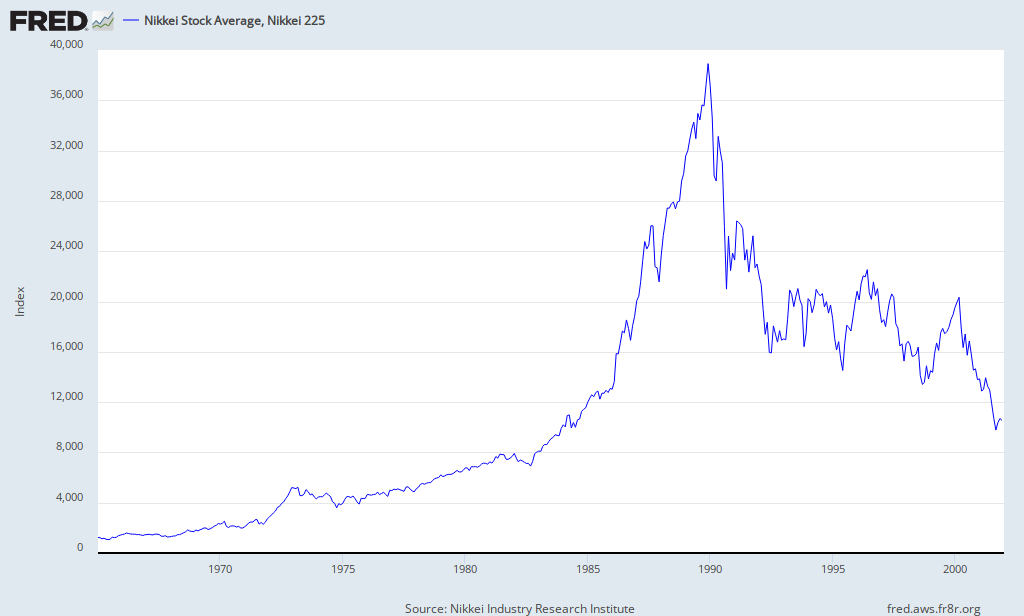

Nikkei Bubble on Slate

Will trade winds turn into doldrums?

Three quick reminders that we should view Japan’s trade from a multilateral context. So has the yen depreciated against its major trading partners? We know the US$ story. But in recent years Japan – China trade surpassed US – Japan trade, while Japan – EU trade expanded to nearly the size of that with the US. So we need to look at the yen versus a wider array of currencies.

As it happens (and, with years of looking at such, unusually) these three graphs all look about the same. But the details, the details! – the yen has depreciated LESS against the dollar than against the yuan or against the euro. Roughly it’s gone from ¥80/US$ to ¥100/US$ or about a 25% swing. Against the yuan (RMB 人民币) the swing is from about ¥12/元 to ¥16/元 or about a 33% swing. Against the euro the yen has dropped from ¥90/€ to ¥130/€ or 40%. So if you approach the topic from an American perspective, you miss the magnitude of the swing.

That however doesn’t mean a huge economic impact. Exports are about 15% of Japanese GDP, so a 10% jump adds about 1.5 percentage points, as a one-time boost. But imports will rise in value [but fall in volume] so the net change will be smaller. There will also be an impact via higher import prices that will take a year to feed through. Again, that will be a one-time shift. Add the two together, and add the 2014 consumption tax rise, and what we’ll see is a return to normal: mild deflation and weak employment.

Trade is not the only factor in the economy, indeed from a European perspective it’s not a big deal. Other things can work in the economy’s favor, indeed other things must: trade alone is neither sufficient nor necesssary.

Note: all figures rounded.

Mike Smitka

Washington and Lee University

New nationalism?

There was a very interesting panel discussion at Temple University in Tokyo about the LDP’s efforts to amend the Constitution and what this portends for human rights. It was noted that part of this LDP effort rests upon a rejection of what is called the Western conceit of universal human rights and an appeal to crafting a Constitution more in line with what the LDP sees as Japanese tradition.

In the question-and-answer session, one of the people asked why this nationalistic LDP effort seems to have more appeal to young people now than it had to young people in, say, the LDP’s early years. Why are today’s young people more nationalistic than young people were in, say, the 1960s? The answer was, basically, “I don’t know. Perhaps because they have been domesticated.” But I wonder if the question’s premise is true. Are young people today more nationalistic than young people were in the early 1960s?

The 1960s are remembered as a time of political activism among the young. But looking at that activism, it had a very nationalistic tenor. It was, essentially, an effort to unleash Japan from the American military. And it was anti-LDP because the LDP was seen as the handmaiden of the U.S. military establishment, as exemplified by the Security Treaty. They were saying we want to disentangle Japan so Japan can chart its own course. True, there was much admiration for Mao and China, but it was the decoupling from the U.S. that was at the heart of the Ampo struggle.

Today, the LDP is positioning its effort as an effort to decouple Japan from a U.S.-imposed Constitution. Never mind that the LDP proposals have a very Chinese ring with the emphasis on the preservation of public order, they are not being proposed as a turn toward China. Rather, they are being advertised as an effort to enable Japan to chart its own course. And it is this appeal that finds support among young people. Is there any real difference in the degree of nationalism involved?

Fred Uleman

Toning down the rhetoric

We sometimes hear that Japan should tone down the rhetoric. And it should. Especially the unprovoked rhetoric such as Abe’s efforts to rewrite history. But at the same time, Japan’s neighbors should also keep their more jingoistic impulses in check.

Case in point: the recent piece in the People’s Daily about how China supposedly has a legitimate claim to sovereignty over Okinawa. China’s defenders will likely point out that this is a newspaper piece and not an official government position paper, but surely nobody believes the government of China does not have a strong say in what the People’s Daily prints.

Fred Uleman